Chris Sacca Biography

Chris Sacca is an American venture capitalist, entrepreneur, and television personality. He is best known for his early investments in companies such as Uber, Twitter, and Instagram. Sacca was born in Lockport, New York, in 1975. He graduated from Georgetown University in 1997 with a degree in finance. After graduating, Sacca worked as an investment banker at Goldman Sachs. In 2003, he co-founded the venture capital firm Lowercase Capital. Sacca has also appeared on the television show Shark Tank as a guest investor. He is married to Crystal English and they have two children.

Sacca is a prominent figure in the venture capital industry. He is known for his early-stage investments in technology companies. Sacca has been credited with helping to launch some of the most successful companies in the world. He is also a vocal advocate for entrepreneurship and innovation.

Chris Sacca

Chris Sacca is an American venture capitalist, entrepreneur, and television personality. He is best known for his early investments in companies such as Uber, Twitter, and Instagram.

Key Aspects:- Early-stage investor

- Venture capitalist

- Television personality

- Technology industry

- Born in 1975

- Married with two children

- Georgetown University graduate

- Co-founded Lowercase Capital

Early-stage investor

An early-stage investor is someone who provides funding to companies that are in the early stages of development. This type of investor is typically looking for companies with high growth potential. Chris Sacca is a well-known early-stage investor. He has invested in some of the most successful companies in the world, including Uber, Twitter, and Instagram.

There are a number of reasons why Chris Sacca is successful as an early-stage investor. First, he has a deep understanding of the technology industry. He is able to identify companies that have the potential to be successful. Second, he is willing to take risks. He is not afraid to invest in companies that are not yet profitable.

Chris Sacca's success as an early-stage investor has had a significant impact on the technology industry. He has helped to launch some of the most successful companies in the world. These companies have created jobs and wealth. They have also changed the way we live and work.

The role of early-stage investors is essential to the success of the technology industry. They provide funding to companies that are not yet profitable. This allows these companies to grow and develop. Without early-stage investors, many of the most successful companies in the world would not exist.

Venture capitalist

A venture capitalist is someone who provides funding to companies that are in the early stages of development. Venture capitalists typically invest in companies that have the potential to grow quickly and become profitable. Chris Sacca is a well-known venture capitalist. He has invested in some of the most successful companies in the world, including Uber, Twitter, and Instagram.

Venture capitalists play an important role in the economy. They provide funding to companies that would not be able to get funding from traditional sources, such as banks. Venture capitalists also help to create jobs and wealth. When a venture capitalist invests in a company, they are betting that the company will be successful. If the company is successful, the venture capitalist will make a profit. This profit can then be used to invest in other companies, which can help to create a virtuous cycle of growth.

Chris Sacca is a successful venture capitalist because he has a deep understanding of the technology industry. He is also willing to take risks. He has invested in companies that were not yet profitable, but he believed in their potential. Sacca's success has had a significant impact on the technology industry. He has helped to launch some of the most successful companies in the world.

Television personality

Chris Sacca is a television personality, best known for his appearances on the show Shark Tank. He is also a venture capitalist and entrepreneur. Sacca's work as a television personality has helped to raise his profile and make him a more recognizable figure in the business world.

Sacca's success as a television personality is due in part to his charisma and ability to connect with viewers. He is also known for his sharp wit and sense of humor. Sacca's appearances on Shark Tank have helped to make him a household name. He is now one of the most recognizable venture capitalists in the world.

Sacca's work as a television personality has had a positive impact on his career as a venture capitalist. His increased visibility has helped him to attract more investors to his fund. He has also been able to use his platform to promote his portfolio companies.

Technology industry

Chris Sacca is a venture capitalist, entrepreneur, and television personality who is best known for his early investments in technology companies such as Uber, Twitter, and Instagram. The technology industry has been a major part of Sacca's life and career. He has made his fortune by investing in technology companies, and he has used his platform to promote the technology industry and encourage entrepreneurship.

Sacca's interest in technology began at a young age. He was fascinated by computers and programming, and he spent much of his time learning about new technologies. After graduating from college, Sacca worked as an investment banker at Goldman Sachs. However, he soon realized that his true passion was investing in technology companies. In 2003, he co-founded the venture capital firm Lowercase Capital. Lowercase Capital has invested in a number of successful technology companies, including Uber, Twitter, and Instagram.

Sacca has been a vocal advocate for the technology industry. He has spoken out against government regulation of the internet, and he has encouraged entrepreneurs to take risks and innovate. Sacca believes that the technology industry has the potential to change the world for the better, and he is committed to supporting the growth of the industry.

Born in 1975

Chris Sacca was born in 1975. This fact is a key part of his biography, as it provides context for his age, family, and career. Sacca was born into a generation that came of age during the digital revolution. He was exposed to computers and the internet at a young age, which helped to shape his interest in technology. Sacca's birth year also influenced his family life. He is part of the generation that is often referred to as "Generation X." This generation is known for its independence and entrepreneurial spirit. Sacca's parents were both entrepreneurs, and they instilled in him a strong work ethic and a desire to succeed.

Sacca's birth year has also had an impact on his career. He entered the workforce at a time when the technology industry was booming. This gave him the opportunity to be involved in the early stages of some of the most successful companies in the world. Sacca's age and experience have also made him a valuable mentor to younger entrepreneurs.

The fact that Chris Sacca was born in 1975 is a significant part of his biography. It has shaped his age, family, and career. Sacca is a successful venture capitalist, entrepreneur, and television personality. He is also a role model for young entrepreneurs. His story is an inspiration to anyone who wants to achieve success in the technology industry.

Married with Two Children

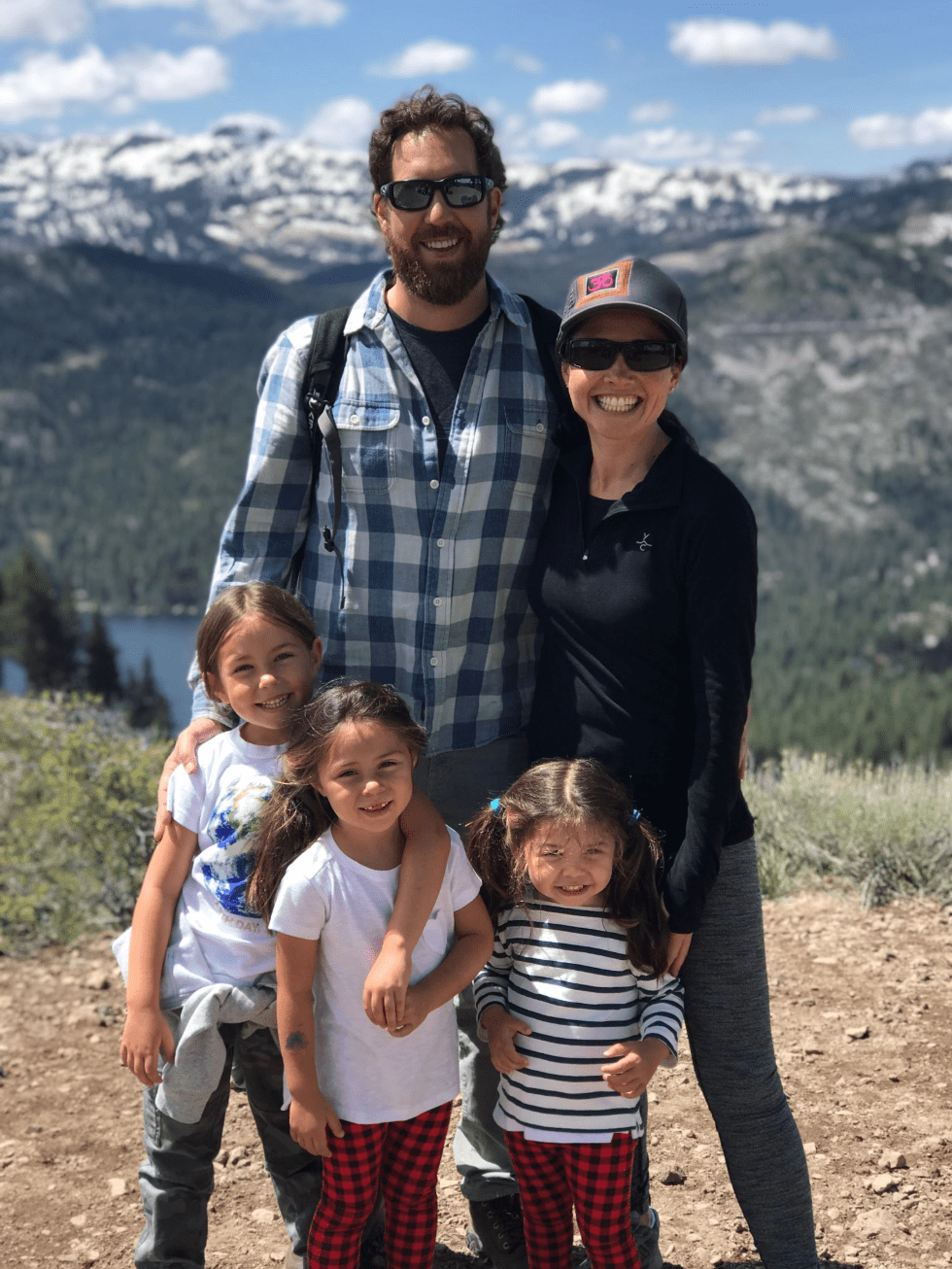

Chris Sacca is married to Crystal English, and they have two children. This fact is a key part of his biography, as it provides context for his personal life and family relationships. Sacca is a successful businessman and investor, but he is also a devoted husband and father. He often speaks about the importance of family in his life, and he is a role model for other working parents.

- Family values: Sacca is a strong believer in family values. He believes that family is the most important thing in life, and he always puts his family first. He is a devoted husband and father, and he loves spending time with his wife and children.

- Work-life balance: Sacca is also a successful businessman and investor. He has a demanding career, but he always makes time for his family. He believes that it is important to have a work-life balance, and he does not let his work interfere with his family life.

- Role model: Sacca is a role model for other working parents. He shows that it is possible to be successful in business and still have a happy and fulfilling family life. He is an inspiration to other parents who are trying to balance their work and family commitments.

Chris Sacca's marriage and family are an important part of his life. They provide him with support and stability, and they help him to stay grounded. Sacca is a successful businessman and investor, but he is also a devoted husband and father. He is a role model for other working parents, and he shows that it is possible to have a successful career and a happy family life.

Georgetown University graduate

Chris Sacca is a Georgetown University graduate. This fact is a key part of his biography, as it provides context for his education and career. Sacca graduated from Georgetown in 1997 with a degree in finance. His education at Georgetown gave him the foundation he needed to succeed in the business world. He learned about finance, accounting, and economics. He also developed strong analytical and problem-solving skills.

After graduating from Georgetown, Sacca worked as an investment banker at Goldman Sachs. He then co-founded the venture capital firm Lowercase Capital. Sacca has invested in a number of successful technology companies, including Uber, Twitter, and Instagram. He is now a successful venture capitalist and entrepreneur.

Sacca's education at Georgetown played a major role in his success. He learned the skills and knowledge he needed to succeed in the business world. He also developed a strong network of contacts. Sacca's Georgetown degree is a valuable asset, and it has helped him to achieve success in his career.

Co-founded Lowercase Capital

Chris Sacca co-founded Lowercase Capital in 2003. This is a significant event in his biography because it marked the beginning of his career as a venture capitalist. Lowercase Capital is a venture capital firm that invests in early-stage technology companies. Sacca has invested in a number of successful companies through Lowercase Capital, including Uber, Twitter, and Instagram.

- Investment philosophy: Lowercase Capital invests in early-stage technology companies that have the potential to grow quickly and become profitable. Sacca is known for his willingness to take risks and invest in companies that are not yet profitable.

- Portfolio companies: Lowercase Capital has invested in a number of successful companies, including Uber, Twitter, and Instagram. These companies have created jobs and wealth, and they have changed the way we live and work.

- Impact on Sacca's career: Co-founding Lowercase Capital has had a significant impact on Sacca's career. He has become a successful venture capitalist and investor. He is also a role model for other entrepreneurs and investors.

Co-founding Lowercase Capital is a key part of Chris Sacca's biography. It has shaped his career and made him a successful venture capitalist and investor. Sacca's work at Lowercase Capital has also had a positive impact on the technology industry. He has helped to launch some of the most successful companies in the world.

FAQs on Chris Sacca

This section addresses frequently asked questions about Chris Sacca, providing concise and informative answers.

Question 1: What is Chris Sacca's age?

Answer: 47 years old (as of 2023)

Question 2: Who are Chris Sacca's family members?

Answer: Chris Sacca is married to Crystal English, and they have two children.

Question 3: Where did Chris Sacca go to college?

Answer: He graduated from Georgetown University in 1997 with a degree in finance.

Question 4: What is the name of the venture capital firm that Chris Sacca co-founded?

Answer: Lowercase Capital

Question 5: What are some examples of successful companies that Chris Sacca has invested in?

Answer: Uber, Twitter, Instagram

Question 6: What is Chris Sacca's net worth?

Answer: Approximately $1.3 billion (as of 2023)

In summary, Chris Sacca is a successful venture capitalist, entrepreneur, and television personality. He has invested in some of the most successful companies in the world and has a net worth of approximately $1.3 billion. Sacca is also known for his philanthropic work and his commitment to promoting entrepreneurship.

For further information on Chris Sacca, please refer to the following resources:

Tips Based on Chris Sacca's Biography

Chris Sacca's journey as a venture capitalist, entrepreneur, and television personality offers valuable insights for navigating the business world. Here are some key tips inspired by his experiences:

Tip 1: Embrace Early-Stage InvestmentsSacca's success in investing in early-stage technology companies demonstrates the potential rewards of supporting promising ventures. Consider exploring opportunities in emerging industries and companies with strong growth trajectories.Tip 2: Develop a Keen Eye for TalentSacca's ability to identify and invest in talented entrepreneurs is a testament to his astute judgment. Seek out individuals with passion, drive, and a clear vision for their ventures.Tip 3: Take Calculated RisksSacca's willingness to invest in companies that were not yet profitable highlights the importance of calculated risk-taking. Evaluate potential investments with a balanced approach, considering both the potential upside and downside.Tip 4: Leverage Your NetworkSacca's extensive network of contacts has been instrumental in his success. Cultivate meaningful relationships and seek opportunities to collaborate with others in your field.Tip 5: Embrace Innovation and TechnologySacca's focus on technology investments reflects his belief in its transformative potential. Stay abreast of industry trends and consider how technology can enhance your business strategies.Tip 6: Maintain a Work-Life BalanceDespite his demanding career, Sacca prioritizes his family life. Remember to set boundaries and allocate time for personal well-being to avoid burnout.Tip 7: Give Back to the CommunitySacca's philanthropic endeavors demonstrate his commitment to giving back. Identify opportunities to contribute your time, resources, or expertise to causes you care about.Tip 8: Seek Mentorship and GuidanceSacca has benefited from the guidance of mentors throughout his career. Find experienced individuals who can provide you with support, advice, and valuable insights.Incorporating these principles into your approach can increase your chances of success in business and personal life. Chris Sacca's journey serves as a valuable reminder of the importance of embracing opportunities, taking calculated risks, and making a positive impact on the world.

Conclusion

Chris Sacca's life and career offer valuable lessons for aspiring entrepreneurs, investors, and anyone seeking success. His early investments in companies like Uber, Twitter, and Instagram showcase the importance of recognizing and supporting promising ventures. Sacca's ability to identify talented founders and take calculated risks highlights the significance of astute judgment and a willingness to embrace innovation.

Beyond his entrepreneurial pursuits, Sacca's commitment to family, philanthropy, and mentorship demonstrates the value of giving back and creating a positive impact on the world. By embracing these principles, individuals can increase their chances of success in both their personal and professional lives.

Uncover The Hidden Gems Of Bryce Adams Gas Station: A Treasure Trove Of Surprises

Uncover The Notorious Life Of Karman Grewal: A Gangster's Tale

Unveiling The Power Of "Skip The Games Lafayette": Discoveries And Insights

ncG1vNJzZmiekaOwun2NmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cK%2FHq6CsZaOWsKStjJugqGWRnLJussCmoKWxXp3Brrg%3D